. . brings a decentralized and democratic economic platform to the real economy! . . brings a decentralized and democratic economic platform to the real economy! |

||||||||

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp DeCom Markets FOMEZ GPEUN LED - Hubs GOMTX Free Economic Value Economic Engine Smart Contracts Universally Decentralized Capital DFDC |

||||||||

|

||||||||

|

||||||||

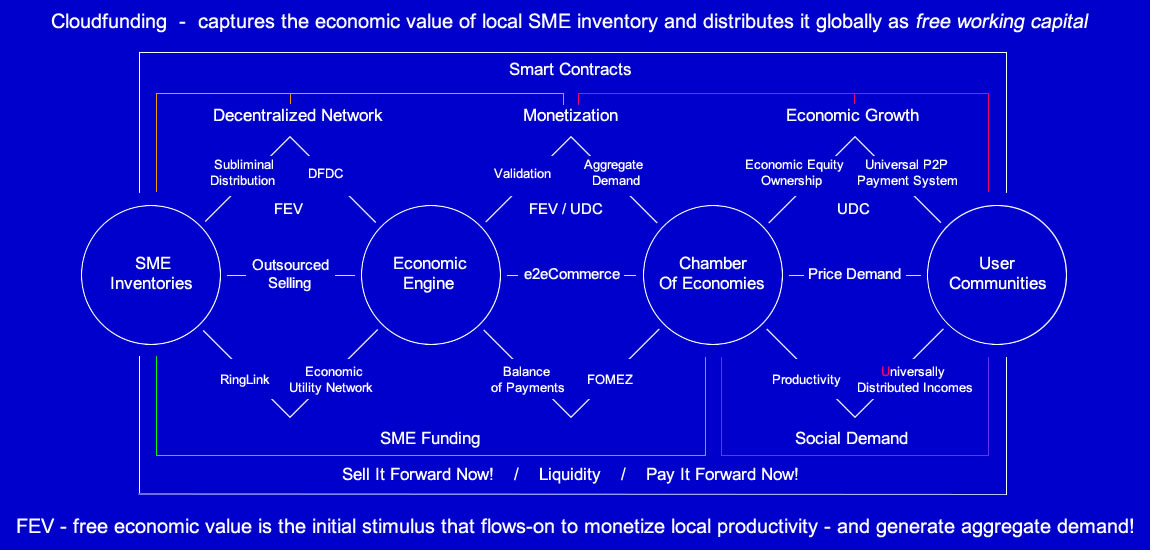

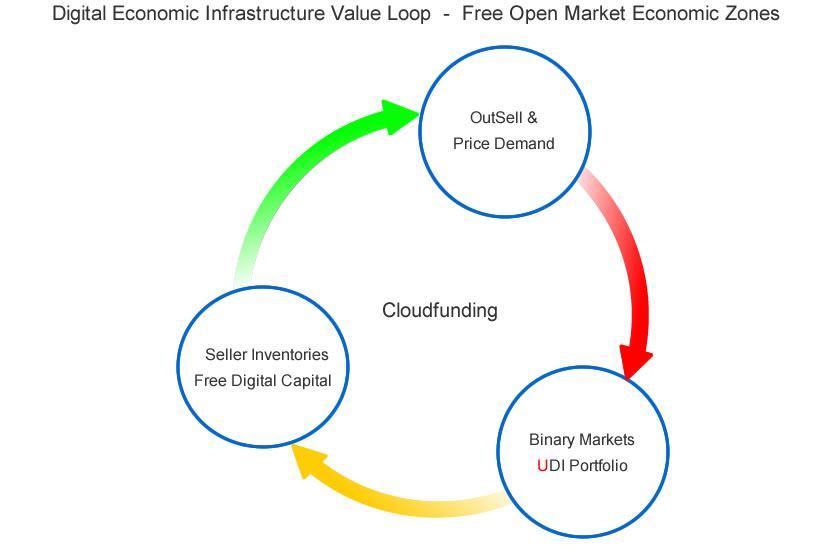

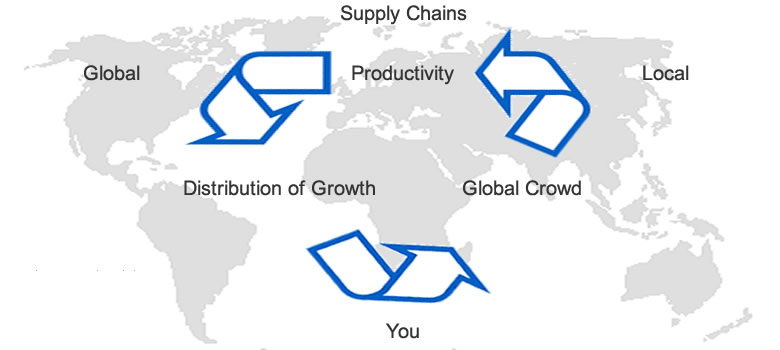

A new era that is digitally scalable The Digital Era will be more accountable, scalable, and autonomous, with Cloudfunding (Cloudalism) integrating commerce between economies along supply chains using a neutral international economic trading unit of account. Cloudfunding harnesses the genuine economic value exchanged in supply and demand with productivity, similar to how the Gold Standard held economies accountable in previous times. The difference now in the Digital Age is that the accountability in genuine productivity can be tracked down to 14 decimal points in the interactions between a buyer and a seller using a mobile phone from anywhere in the world, in real-time. Linking directly to productivity allows for infinite accountability and global scalability with digital technology, perpetually cycling supply aggregate demand in a recycling mechanism to generate a value of incremental economic growth, replacing the need for inflation. The accountability is constantly validated and compared with global currency values, allowing the New Digital Economy to operate autonomously and independently in parallel to the Old Economy without incurring debt. The New Economy combines commercial trade between countries, regions, and local cities, coming in various forms like the new sharing and gig economies, taking in on-demand services. It represents a paradigm shift from the control held over supply and demand by financial markets to an autonomous economic market structure democratically controlled by the global society. Cloudfunding (Cloudalism) operates above B2B and B2C, connecting economies to economies with e2eCommerce in a seamless flow of supply and demand between local and global buyers and sellers using a neutral Universally Decentralized Capital. Its scalability is due to the Direct Foreign Decentralized Capital (DFDC) that monetizes inventories using the aggregate demand of products and services sold across the world in local economies, giving rise to a democratic Balance of Payments that helps eliminate inequality among countries and regions. In the background, Cloudfunding separates the supply side from the demand side in two separate open markets where incentives can be implemented to stimulate activity in the trading of products and services from sellers to buyers. This is done by tracking the UDC ownership between buyers and sellers without the platform holding or transferring any local sovereign currencies between local economies or across borders. Cloudfunding operates with all global currencies using a neutral digital trading unit of account that acts as a global trade currency to process commerce activity across industry verticals. The New Economy holds no physical cash (cashless) and carries no credit or debt within its economic infrastructure and ecosystem, only needing to compare with local cash for a neutral Universally Decentralized Capital to exchange ownership between a buyer and a seller in a commercial trade. Being a neutral trading unit, it flows ubiquitously between the various global currencies, offering more privacy and security for all users due to the independent and autonomous design. Cloudfunding is an equity-based economic ecosystem sitting above the commerce level and operating as a neutral Operating System (OS) that maintains the secure independence of all users. It freely provides the mechanics for all suppliers/sellers to outsource the selling of their products and services on a global scale, fully monetizing the seller's full selling prices. It incentivizes an independent global network of market makers to be the new digital workforce, democratizing global productivity by interconnecting and sharing directly in the economic growth and wealth, equitably. Supply is not complete without demand, and Price Demand offers the benefit for buyers to create real-time demand by buying at the price they want to pay. Cloudfunding is credit and debt free Cloudfunding offers commerce a free economic value system that doesn't operate with credit. It avoids recessions by not accumulating debt, contrasting with the banking industry's business model that relies on risk management, creates debt, and passes it on to private and public sectors, extracting rents while causing collateral damage during the recovery of debt from private and public sectors. Free Economic Value is validated and governed by genuine productivity in commercial trade of products and services, physically and digitally restrained globally in its scalability. It is encompassed within the Global Chamber of Economies in Global Binary Markets linked to global productivity. Cloudfunding uses Free Economic Value (FEV) in the Outsourced Selling process to incentivize the Global Crowd to drive the initial step of selling a product or service between a seller and a buyer. The Outsourced Selling process uses a unique democratic bidding to fully monetize individual inventory items before releasing them to the seller's local buyers. After the global process, the Price Demand function is made available to local buyers to buy product and service deals at prices they are willing to pay. Overall, Cloudfunding can sell products and services exponentially faster than production or manufacturing, including the use of robots. The speed of selling exponentially is solved by algorithms that incentivize trade between supply and demand for every unit of products and services at the global level before releasing the products and services at the local level with Price Demand. From economy to economy, trade exponentially speeds up with Subliminal Organically Decentralized Advertising, an important part of the paradigm shift in the era where inclusion for all is paramount. |

||||||||

|

||||||||

The New Digital Economy finds its foundation not in modern technology but in history, dating back over 70 years to the Bretton Woods Conference. During this event, a concept proposed by British authorities suggested having a global "unit of account used to track international flows of assets and liabilities," operating with a neutral trading value from a central mechanism. Cloudfunding tracks every value exchanged between buyers and sellers in trade, moving from country to country, giving countries a real-time view of trade surplus and deficit data that they can respond to without delay. This concept, introduced by John Maynard Keynes, was ahead of its time but with today's technology and a need for a new direction to sustain global economic growth, Keynes' proposal aligns with the ideology of what today's societies need to replace the dysfunctional global financial system. It is a democratic system controlled by the global crowd consensus and scalable, allowing sustainable global growth to benefit everyone. |

||||||||

| Introducing DeCom - Decentralized Commerce: | ||||||||

| Cloudfunding is DeCom | ||||||||

| " Cloudfunding does for modern economies in tokenizing the local economic value . . as what the invent of coinage did for commerce and trade in ancient times! " |

||||||||

|

||||||||

| " Now, local economic value is universally issued, owned and governed by the people, for the people . . to fully monetize productivity across global commerce and trade! " |

||||||||

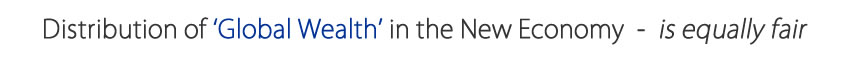

The New Economy digitizes and democratizes the commercial flow of value through global trade and commerce using digital technology to track a neutral international unit of account, similar to the International Monetary Fund's (IMF) Special Drawing Rights (SDR) concept. However, SDR is a restricted Special Drawing Rights value, a foreign-reserve currency also termed as XDR, created like quantitative easing but without printing money or having true backing. Its objective is to replace gold and U.S. Dollars, and its role is for IMF member countries to draw down the SDR at various costs to be exchanged between trading countries to balance trade surpluses and deficits. The New Digital Economy, particularly with Direct Foreign Decentralized Capital (DFDC), validates Free Economic Value against genuine global productivity into Universally Decentralized Capital, allowing it to be globally used (compared to the limited use of SDR) to fully democratize trade. It removes incumbents, opening up global economies to free open markets with an interconnecting ubiquitous flow using a neutral international economic trading unit of account value. This makes it freely available for the people of the world and countries to control and operate with in real-time within the real economies. |

||||||||

|

||||||||

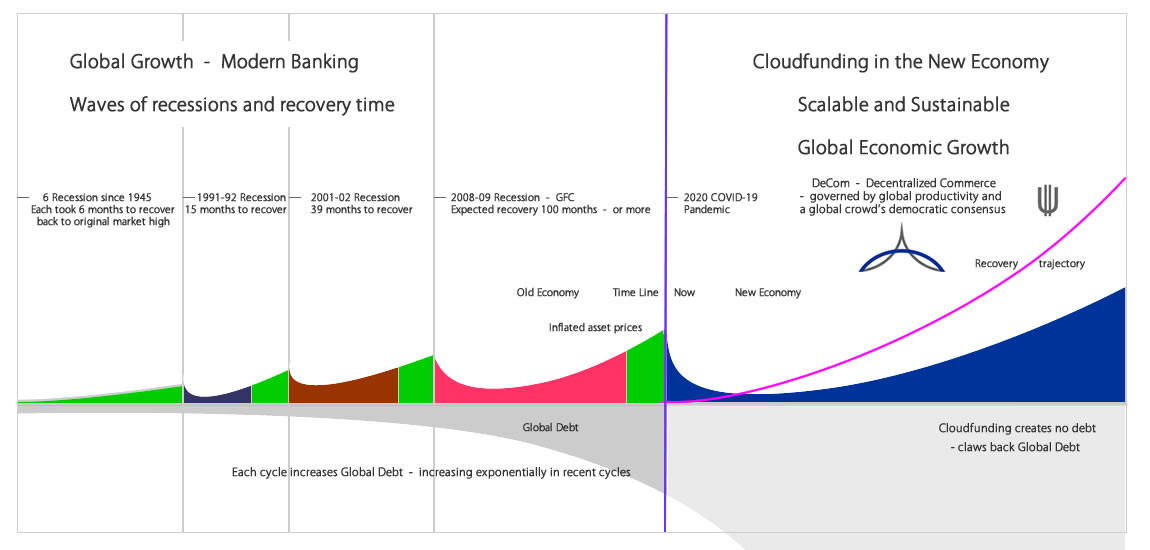

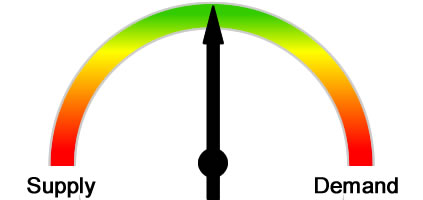

Modern Banking and Finance is limited Since World War II, there have been nine major recessions. The first six lasted only a few months, but recovery took 6 months to return to the same market level before the recessions. The world has experienced three major recessions since then, with the Global Financial Crisis being the most recent. The impact of the 1991-92 and 2001-02 recessions on many economies was a significant turning point in the global economy's growth. Each recession had an extended recovery time, 2.5 times longer than the previous recession. This compounding effect is similar after the GFC, with a much flatter recovery that has been running for years instead of months. If the trend continues, full recovery might not be achieved until the next recession hits, potentially leaving the world in perpetual stagnation. The emperor is wearing no cloths The tools used by central banks and monetary policies involve adding printed money to the system to stimulate productivity. However, the money does not reach the areas where productivity takes place; it is held by money suppliers, propping up markets where investors seek their share. Consequently, the debt held in the background multiplies exponentially. Markets have been propped up by an un-validated type of currency value, printed to give share market profit takers a kick-back, hoping that the profits are spent in the economies. This old top-down thinking may have worked before, but the game has changed. The Digital Era and Cloudfunding, operating with real-time information and value, have exposed the flaws in how they create and back their free money. The era of betting on the future outcome of productivity has reached its end. Now, productivity needs to be truly evaluated in real-time with real products and services, along the entire supply chain, and scaled globally across all country economies. By syncing supply and demand, it can achieve and distribute true growth across competitive markets. Hence, a new economic model needs to be adopted, capable of scaling with the changing demographics of the world's economies, which will be evolving dramatically in the near future. Eliminating the compounding Risk and Debt The reliance on credit to create productivity since the 1980s has weakened family units by forcing them to take on more and more debt to drive productivity for the nation's economic growth. The risk has a compounding impact on individuals, families, and countries in most developed nations, particularly with the exponential increase of aging populations, which increases the effort needed by the remaining workforces. This requires them to take on more debt and risk under recent banking methodology. Over the last few decades, on a trade and economic level, the world has become more interconnected and reliant on other countries. This connection is based on indebtedness between countries and financial institutions, where credit and debt are used as the tools of incentive imposed on countries to increase economic growth. This inevitably trickles down to family units and individuals, encouraging them to take on the burden of more debt and risk or be denied a better standard of living. For most countries, the challenge in recent decades has been to encourage citizens to take on debt, often using a subtle approach by hiding the growing burden on populations. This is done using financial and economic statistics, knowing that most information released is beyond their understanding. Cloudfunding is the paradigm shift Cloudfunding represents a total paradigm shift away from imposing debt on society in exchange for a better standard of living and growing economies. Instead, it achieves growth through the borderless distribution of Free Economic Value, incentivizing productivity without incurring debt. As the world moves fully into the digital age, the distribution infrastructure for achieving outcomes becomes much faster, requiring value to be distributed for productivity along the line. Cloudfunding takes a new path by removing the need for gatekeepers, such as rent seekers, who control the flow of capital for a cost. This global distribution and generation of value are disrupted in the Digital Era, changing the dynamics of the traditional commerce cycle. Cloudfunding gives Supply (Seller) and Demand (Buyer) each a democratic position that, together, closes the loop in the Commerce and Trade cycle with a sustainable equilibrium in global productivity. |

||||||||

|

||||||||

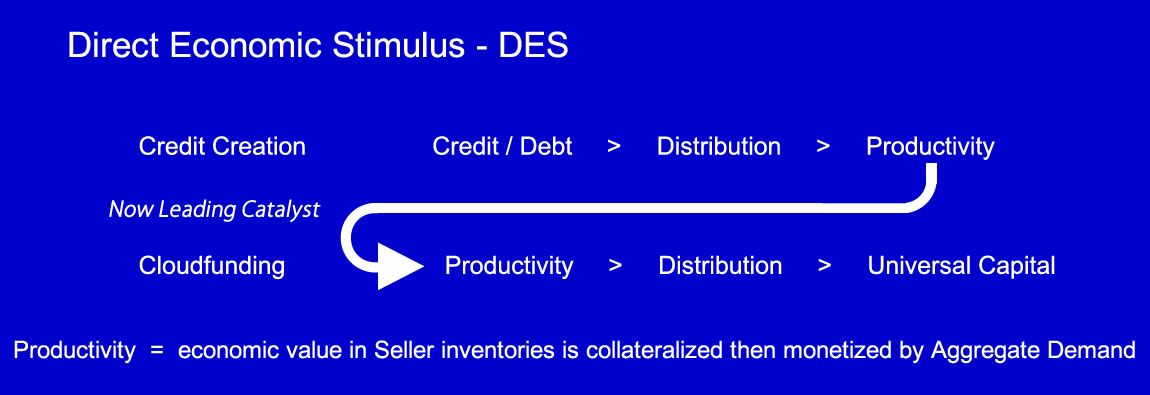

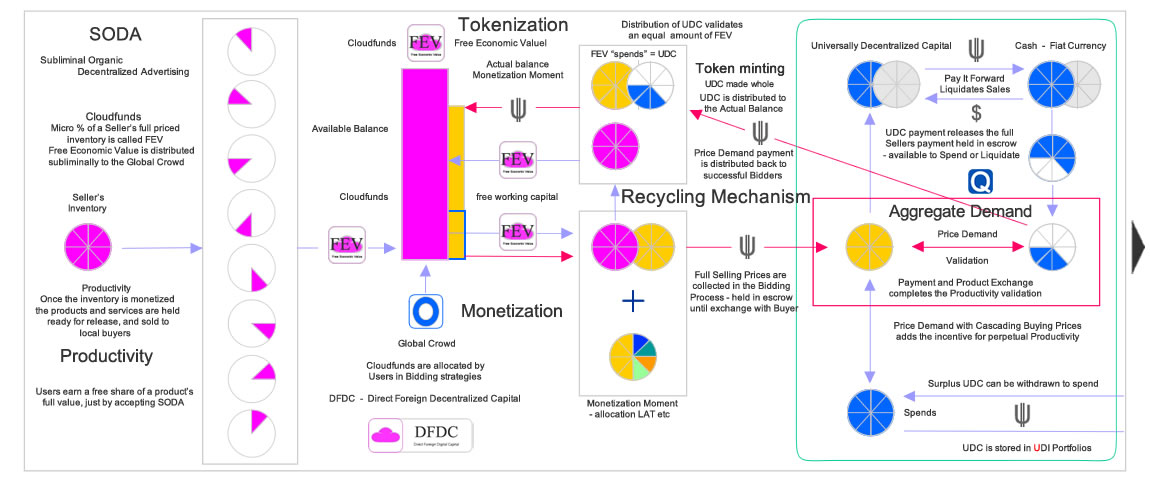

SMEs lead the stimulus with their inventories Direct economic stimulus - DES, is true equity capital, not credit debt, and it's drawn from the aggregate demand of genuine products and services sold around the world that is distributed to the global market maker network that drives the supply side of the local markets to achieve real Productivity. |

||||||||

|

||||||||

It means sold Productivity is monetizing new Productivity with validated equity capital, which is generated by the real-time Aggregate Demand of the sold products and services on a global scale - basically flipping the Credit Creation model around to use Productivity as the leading catalyst with debt free capital that finances SME inventories ( before selling to local buyers ) and they in-turn distribute new capital flows out into the local economies via operating costs and wages. |

||||||||

|

||||||||

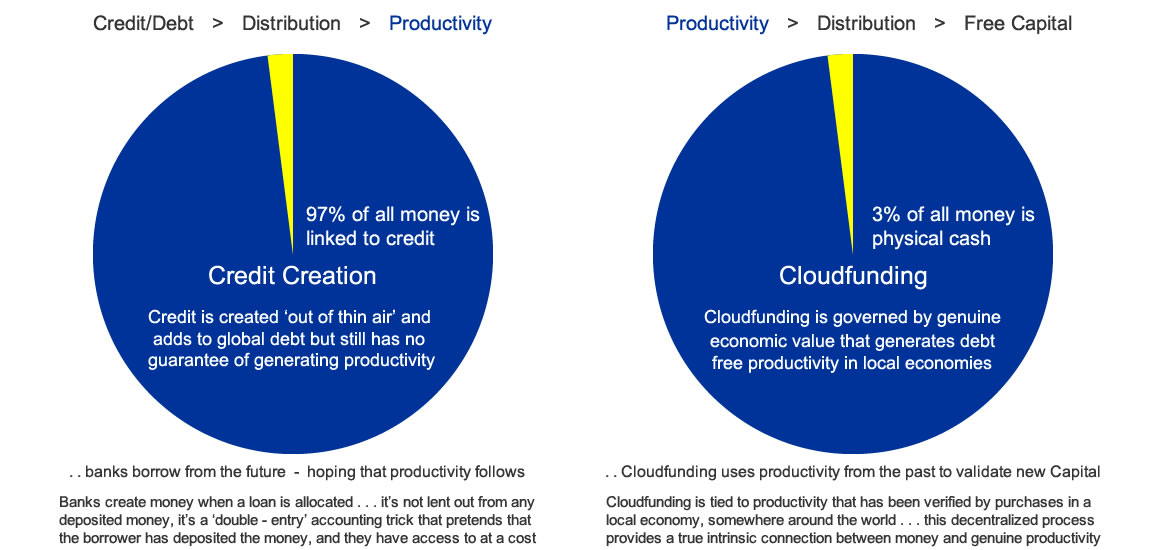

Cloudfunding closes the loop in the dynamics of Commerce Digital technology and networks have proven that the distribution of advertising can support a large network of businesses and industries, with some digital players generating more revenue than entire developed countries. Cloudfunding shifts away from this proven model of inward-flowing value that takes value out of productivity's overall supply and demand chain profits by large networks. Instead, it reverse-engineers the flow so the marketing value is distributed outward at an exponential scale as Free Economic Value and gives it the flexibility to become free working capital in the hands of individuals in the global crowd. These individuals become the new democratic gatekeepers in driving profitable outcomes towards the world's large number of SMEs that gain strength from localization in Free Open Market Economic Zones (FOMEZ). The distribution of credit by banks is constrained by the economic outlook and the risk of giving credit, which is limited to adding numbers in the debt and credit columns. In contrast, the distribution of Free Economic Value has no risk of being made into credit, as it is algorithmically constrained within the volume of productivity across all types of markets. Cloudfunding reverses the position of productivity, placing it ahead of distribution and reversing the way banking uses debt as its leading function in the flow of commercial dynamics. |

||||||||

| Banking Cloudfunding | ||||||||

| Credit/Debt - Distribution - Productivity Productivity - Distribution - Free Capital | ||||||||

|

||||||||

| The gap between the two distinct distribution methods of banking and Cloudfunding will decrease exponentially as technology advances, and individuals play a significant role in how global markets operate. Cloudfunding revisits history and brings John Maynard Keynes' concept into the Digital Era by providing the neutral mechanism that directs the flow of Free Economic Value into the reformed global open markets. Technology is now capable of distributing free capital exponentially on a global scale, surpassing the distributed volume of credit applied by banking within a Global Chamber of Economies. Outsourced Manufacturing will shift to Outsourced Selling It has taken several decades to see the real outcome of moving manufacturing to low-wage developing countries, forcing the closure of industries in developed countries. The false belief that using financial methodology to multiply money supply and create credit and debt to buy cheap goods did not counterbalance the loss of manufacturing jobs in developed countries, and this unequal balance in globalization is now apparent. With any crisis comes a time to reflect and find new ways to move forward. The era of shifting manufacturing to countries with cheap labor, exploited by the likes of the East India Company during the British Empire, has reached its peak downside. The 4th Industrial Revolution, or the Digital Age, has exponentially moved forward the real outcomes now being seen in developed countries regarding globalization's impact on all fronts. The transition to a fully digital world will be faster than any previous revolution, growing at an exponential pace with global internet and mobile communication connections. The mobilizing of the world through global connection jumps barriers confronting people in developing countries, who only get a fraction of local economic gain, and those in developed countries carrying the burden with debt via credit for a share in local economic gain. The mobilization places all global individuals on the same level of connection, opening up new ways of looking at how to streamline equalization between various fronts and discarding what has caused the disparity in the population. The main challenge is directed towards incumbents that have positioned themselves between and extract rents and value through speculation. The digital era does not need to follow the models of the analogue world, which has its roots in the early exploitative days when markets (traders) positioned themselves between producers and those who eventually bought products. The same trading mechanism today, still operating in between, does not reflect the true markets, as the fundamental role of traders is still to sell at a profit regardless of what the real world can support and leaves it up to players closer to the end buyer to start discounting the selling price to find the real market demand. Connecting the mobilized global population directly to producers, manufacturers, wholesalers, and retailers is streamlined with Direct Foreign Decentralized Capital and Outsourced Selling, synergized with Free Economic Value to remove barriers in funding productivity between the players in the supply chains, connecting them all on a fully autonomous platform independent of the current dysfunctional incumbent institutions. Cloudfunding economics moves beyond the thinking that a digital or crypto currency itself is the answer to the world's economic struggles if speculation and storage are the main values. Cloudfunding rewrites the economic mechanics behind domestic and global productivity by directing real value into markets tied back to real people working for both themselves and the betterment of others in the real world. The change in how markets will start to work comes with the change in how influence and value crosses borders to stimulate local economies, initiated by the actions of local sellers using free Direct Foreign Decentralized Capital. Cloudfunding does the rest. |

||||||||

|

||||||||

Automatically flows into Universally Distributed Income ( UDI ) Portfolios With all commerce activity on the platform, each product and service processed with Outsourced Selling and Buying is linked back to the Universally Distributed Income (UDI) Portfolios, from which all users can build a collection of Location Tokens and gain a share of the Location Activity Tax collected and distributed across global activity in real-time. The method of capital investment directed into industries and businesses is the backbone of modern banking, which involves risks when there's a shift in markets or a lack of profit due to the cost of productivity. The typical return on capital investment comes from liquidating shares in a company after an increase in value, via dividends, or leaving it up to wealth managers. UDI Portfolios challenge this form of wealth distribution by directly focusing on reducing the wealth gap and inequality through inclusive growth. UDI is a tracking mechanism of global citizens' use of tools to engage in supporting various locations around the world where commercial productivity takes place. The initial entry is when they support local businesses and help the velocity of local cash flowing in the local economy. What follows is a unique way that global citizens can link themselves instantly to where they think productivity will happen. What doesn't change in UDI is that risk is not part of this automated distribution because productivity is either positive or nil but never negative. The real-time productivity data and results are unique, with the distribution of value that comes directly from the local activity where the global citizens are linked through the number of locations collected. What makes this distribution process so transformative is that it distributes the increased value from global productivity directly into the hands of global citizens to increase their individual wealth, doing away with costly management fees and risk as the UDI Portfolios are free of costs. UDI is a free digital distribution process of global productivity profits directed to grow local economies, which is far different from the capital investment vehicles that financial institutions use to extract rents as part of their business models. |

||||||||

| Debt reduction is a must Reducing debt can be approached in various ways, such as reducing spending and living within one's income source. However, the difficulty lies in large economies, like countries, having to reduce services that populations have relied on, leading to many flow-on consequences and lack of confidence to go out and spend. In the Digital Era, reducing debt can be achieved with scale and technology, overcoming the indebtedness placed on populations, businesses, and governments by the banking industry with multiplied money based on future wealth. This future debt can be reverse-engineered to exponentially recover debt in personal and corporate sectors, allowing true productivity to drive the economy without reducing the already-hard-earned pie. This will restore confidence for populations to go out and be productive. The Scalable Digital Economy is digital to the extreme, not burdened by carrying a legacy tied to old-world banking systems with physical infrastructure or individuals' personal or business debt from the old economy. Instead, it focuses on giving everyone the advantage of reducing debt by solving inequality with cloud-based technology. To move forward, the New Economy incentivizes both Supply and Demand and Sellers and Buyers simultaneously. Cloudfunding can bring real-time Demand into all types of commerce with Price Demand as incentive, focusing on local communities and economies that generate productivity at the local level - Localization. Outsourced Selling applies Price Demand to change the dynamics of commerce, giving a Seller a comparative advantage over competitors, even if they use heavy discounting or dynamic pricing. The New Economy integrates a complete series of commerce functions into an ubiquitous flowing economy that operates as the Global Open Market Trade Xchange (GOMTX). Cloudfunding absorbs commerce payments into its ecosystem by removing incumbents and does not isolate itself from global currencies. It is continually compared in real-time with all global currencies during the direct commercial activity between Sellers and Buyers in the final exchange of payment for product. The platform features a fully autonomous SaaS architecture structured to operate as the ComTechX Industry, adding incentives for the Global Crowd to be involved in changing to a decentralized model with a digital infrastructure that empowers players along the supply chains. |

||||||||

|

||||||||

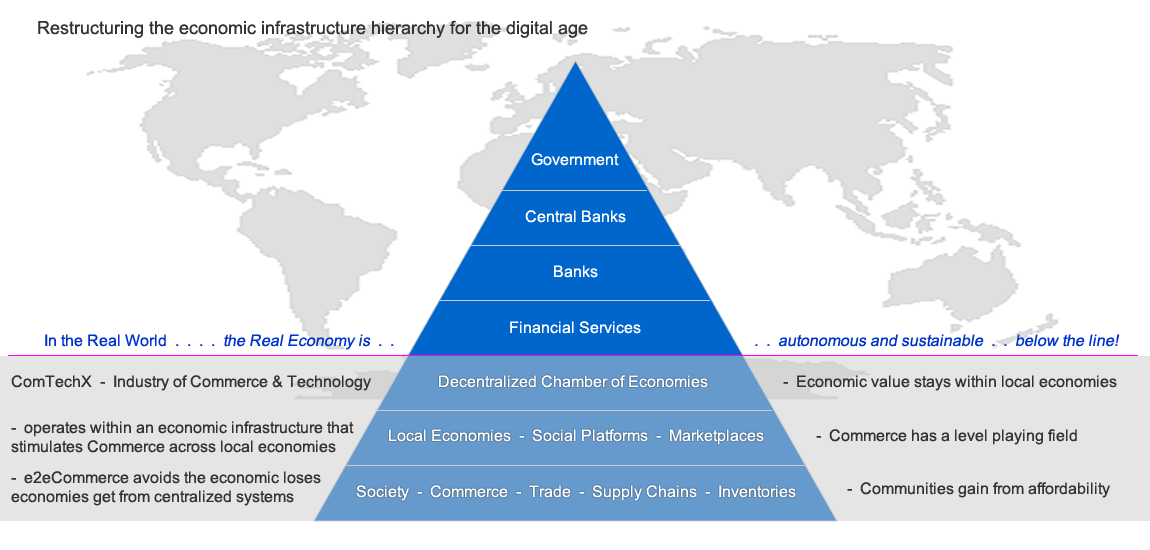

| ComTechX, the industry, combines Commerce and Technology, bringing together Offline and Online Commerce into the new economy with a streamlined commercial ecosystem. It operates in an autonomous infrastructure, similar to how the internet was intended, with an ubiquitous universal value synchronizing all global economies to operate as one.

Most countries' economies have been separated into two separate entities: those below the line, producing and adding economic value, and those above, taking from that economic value. The Global Chamber of Economies provides local economies with a voice and platform to operate independently and retain the economic wealth produced. Separating Commerce from the Banking and Financial System in Cloudfunding's economic infrastructure works similarly to the Glass-Steagall Act, which operated from 1933 to 1999. This Act separated the retail side of banking from the investment side, which involved speculation in stock markets and was a primary cause of the Great Depression. Local SMEs can change the status quo by outsourcing the selling of their inventory at guaranteed full selling prices, gaining a competitive advantage against big box competition. Cloudfunding provides SMEs with predictable cashflows, giving them the confidence to invest in stock and upgrades, leading to job creation and a better local economy. |

||||||||

|

||||||||

|

||||||||

| Establishing the New Economy in the Digital Era involves exchanging physical cash for digital cash in a validation process that only "kisses" the local currency during typical commerce activity at brick-and-mortar stores, the transition point. Digital cash is not a currency per se but functions as a stable neutral global trading unit of account value. The exchange leaves the physical cash in the hands of Buyers and Sellers to continue circulating in the local economy.

This makes the New Economy truly cashless, with only the ownership of the digital cash needing to be securely tracked and recorded during worldwide commerce activity, free of any fees. This paradigm shift positions the Digital Economy parallel to the Old Economy with an ideal transition gateway between the two that's simple and free to exchange cash and digital cash as part of daily commerce. The distinct difference between the New Economy and the Old Economy is that physical cash in the Old Economy must be held by a bank, and for a fintech service to operate, it must hold the money within its business model, making it only a digital form of accountability, used for decades, even centuries, since physical bank books or paper ledgers were introduced for account holders to keep records. Commerce in the New Economy changes this for both Buyers and Sellers, with no incumbents as in the Old Economy. The platform operates with a fully autonomous SaaS architecture, structured to form the ComTechX Industry. A Scalable Economy changes how money flows in global commerce with Free Economic Value and Free Direct Backing. Businesses and StartUps can get Free Direct Backing for their ventures without loans or giving away equity. Sellers now have a Digital Sales Division where sales aren't about marketing follow-up and talking-up sales but about digital strategy. |

|

|||||||

|

||||||||

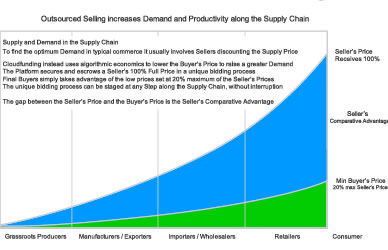

A New Economy is entirely digital but physically cashless, providing a seamless transition from the Old Economy to the New Economy. Local Cash is exchanged with Digital Cash at local brick-and-mortar stores during everyday trading, with Buyers and Sellers freely exchanging ownership. This ownership marks the paradigm shift from being part of a monetary system to a scalable economic system, changing the dynamics of how global commerce and trade payments move freely from economy to economy while eliminating the costs incurred with old-world incumbents. The New Economy has the economic mechanics to provide incentives and affordability to both Sellers and Buyers, offering full 100% selling prices for Sellers and buying power for Buyers with as low as 20% buying prices, generating growth with guaranteed sales. Local activity is networked together and played out on a global scale within the Global Productivity Grid. The Old Economy is cyclical, structured to be speculative and profit-taking, while the New Economy is exponential, scalable, sustainable, and equitable. |

||||||||

|

||||||||

Offline to Online is O2O - giving Localization a defendable position in Globalization The Old Economy allowed banks to act on both sides of commercial activity, effectively double-dipping in the same exchange of goods by gaining fees from both Buyers and Sellers in most global commerce. Banks were necessary due to distance and convenience in holding fiat currencies, but these times are quickly disappearing with digital alternatives. It's no secret that for the 20th Century, the economic infrastructures of developed countries were built as pyramids designed to use the many at the base to feed upward to the top. When the bottom could no longer be incentivized to feed enough upward to the top of the pyramids, a recession was announced, stating there was a correction to balance the market, leaving the bottom many to bear the losses with devalued assets. This method of using the many (masses of skilled workers and businesses in the main productivity sector of economies) will face an impossible position due to simple demographic changes, unable to support any stability, growth, or continued feeding of the incumbent middlemen. In the coming change in jobs lost through automation and demographics, the sector most affected will be financial services and white-collar jobs, the largest sectors in developed countries, employed to help move value from workers in manufacturing and general production of products and services – the actual productive sectors in developed countries are already smaller sectors in the economy, although they create the initial genuine value in the supply chain. The 21st Century and the New Economy will change the flow in economies by keeping the flow of productivity value and currencies in the hands of the groups that create it, generating better tax revenues for governments to support overall infrastructure and services. The New Economy bypasses the need for incumbents altogether by combining the commercial exchange into one action for free, even if multiple fiat currencies are involved. It bridges the gap between Buyer and Seller by changing the status quo in commerce's dynamics, traditionally the buyer paid equal to what the Seller agreed, but this is not the case with Outsourced Selling and Price Demand, across the entire supply chain. The New Economy opens the door for more fluent and efficient local and global trade routes that can multiply to a sustainable level of global productivity, helped along by integrating Free Advertising and Free Economic Value into the hands of the masses. The transition of advertising, from being part of the mechanics of Commerce, to its distribution as Free Economic Value, and its validation as free working capital tied to genuine global productivity in the supply and demand of products and services, through to its final validation as a neutral global digital trading cash, is key to the ongoing perpetual flow of economic growth in the New Economy. Needs to have 'purpose' The New Economy must have a clear purpose, addressing the big issues while minimizing casualties and maximizing results, not just to disrupt the status quo. During the transition, participants will have a foot in both camps, leading to two distinct economies until the majority shifts. This is why Outsourced Selling and Price Demand have a purpose in accelerating the transition by providing maximum benefit to Sellers and Buyers. With Outsourced Selling's mechanics and global scale, the number of digital jobs available in any local economy can be significantly higher than the number of jobs lost due to automation. The multiplication effect achieved by one single digital job can greatly increase local productivity, requiring the addition of new physical jobs. There's a massive flow-on effect when an increased quantity of Sell High/Buy Low priced products and services are available to local economies, where Buyers have greater buying power. |

||||||||

| Global productivity is structured as an Inclusion Paradigm | ||||||||

The New Digital Economy incorporates the inclusion of all people, enabling anyone from anywhere to be involved in the productivity within marketplaces that have traditionally been exclusive to traders dealing with products and services in global supply and demand. The weakest point in any economy is the velocity of products and services moving from the supply side to the demand side. The typical tools and strategies used to encourage this velocity have been to discount until demand is found, regardless of the lost profits. This conventional strategy is a race to the bottom with no real winners in any economy. However, the Digital Age has the capacity to use digital technology to change the rules of commerce and save economies from incurring those losses. |

||||||||

|

||||||||

Removing barriers The Digital Revolution differs vastly from the Industrial Revolution but both will have significant changes to the infrastructure and mechanics of how industries operate and how people will be replaced in many industries. People needed to adapt to the Industrial Era's New Economy. This time, in the Digital Revolution, the changes may have different barriers and be less tangible, but being digital means things can be changed at an enormous scale, bypassing incumbents and barriers that were formed during the previous era. During the transition to mechanization in industries that produced and manufactured, agriculture was the prime example of the great changes, with job losses from around 98% of employment down to 2%. In the last half-century, manufacturing has been the focal point of job losses to automation, but the industry most likely to be affected will be the largest industry in most developed countries. The transformation that happened to agriculture during the transition to the Industrial Age with machines replacing manual labor will happen to the banking and financial services industry in the Digital Age of Inclusion, with algorithms that will never forget and scale exponentially with true values. This will remove the need for manual labor in risk management and speculation with the cost of money, eliminate human judgment in who gets the benefit of finance, and include everyone in real-time, without incurring debt. In the transition from one era to another, there are always incumbents trying to move across and maintain the same control as before. The gatekeepers in the commercial and financial sector are no different. Cloudfunding replaces those incumbents (rent seekers) with a more direct connection between Buyers and Sellers, with the Global Crowd as the new gatekeepers, democratically controlling the new equilibrium of trade as it's tracked internationally, providing all services for free. Regardless of the products or services produced, manufactured, or invented, they all need to be sold from a Seller to a Buyer. Cloudfunding provides the new equilibrium between Supply and Demand with Sell high and Buy low to allow economies to scale, equitably. |

||||||||

The New Digital Economy is 'its own beast' The Digital Era, like other times in history, had unique sectors, with the Digital Age focusing on people and data. Social media revolves around people communicating and data collection. The collective interaction of these two components is where the New Economy operates. Privacy will be paramount to all participants in the Digital Era, just as people share various forms of communication in their daily lives while holding back private details, especially financial matters. This is why the New Economy will always operate separately from other sectors without blurring the lines between privacy and sharing. Commerce is the intersection between a buyer and seller in any economy, and this intersection will be digitally driven as automation takes physical jobs away. Digital jobs that can exponentially multiply are the only way to replace those lost jobs, offering relief to debt-burdened societies. By having more free time, individuals can be more productive as global gatekeepers between Supply and Demand, stimulating growth. Sellers will gain more control with their own sales and future with the Digital Sales Division, opening up new possibilities for business growth in Free Open Market Economic Zones (FOMEZ). Reinventing advertising as a free asset class value provides the synergy needed to give Buyers and Sellers a level playing field, allowing more individuals to make the transition to the New Digital Economy, each driving more global productivity. |

||||||||

Place of Trust The New Economy separates from the Old Economy at the age-old Place of Trust, where fiat currency is exchanged with a digital cash trading currency for free, allowing fiat currency to continue flowing in local economies. This is the transition point from the Old to the New. The ecosystem only needs to securely track the ownership of the digital trading cash in global commerce, enabling the free Outsourced Selling process to integrate new marketing technology, finding a local buyer for any product or service in a single process on a global scale, with predictable and serendipitous sales results. This contrasts with the Old Economy, where a banking system has, over centuries, fit between buyers and sellers, adding costs and removing fiat currency from the local economy by holding it in various banking clusters and releasing it at their discretion, controlling the flow of local economies. Banks are just another business, and their product is credit and debt. The world is entering a new era with no blueprint to follow like before in the slower Old Economy. A whole new way of thinking outside the box is needed, with governments not being the instigators but instead distributing the new digital revenues that will flow from increased productivity. The world can now finally access the largest natural resource waiting to be tapped – people. The sheer economies of scale using their newfound connectivity will power the world's productivity of products and services for generations in the Digital Era. New Digital Trade Routes The New Economy is embarking on a novel journey, establishing a cutting-edge sector and novel trade routes that specifically target global commerce, aiming to revolutionize the interactions between buyers and sellers. Moreover, it introduces a unique mechanism to distribute a global wealth tax derived from the global productivity across the world. Conversely, the Old Economy is progressing in a direction opposite to where the banking industry within the Old Economy is striving to go. It continues to adhere to the legacy of an outdated, debt-ridden financial system, relying on the belief that tweaking peripheral fintech services can alter its fate. The Old and New Economies are built on fundamentally disparate architectures. The Old Economy relies on a third leg—a middleman that extracts a fee from every transaction in local and global commerce. In contrast, the New Economy eliminates the middleman, streamlining the commercial process. Its structure is designed to address the legacy debt inherited from the Old Economy by exponentially assisting individuals in reducing their debt as the Scalable Economy takes shape. |

||||||||

The New Economy, a pivotal component of the Digital Technological Era, operates at an exponentially accelerated pace on a global scale, offering a solution to the worldwide economic debt cycle that many nations are trapped in. In contrast, the Old Economy's banking system employs debt multiplication strategies to fuel growth, relying on the accrual of debt. The New Economy counters this by multiplying productivity and purchasing power through Outsourced Selling. The New Economy's disruption extends beyond mere retail commerce exchanges, permeating throughout entire supply chains, from agricultural production to manufacturing and industrial enterprises, encompassing both hardware and software, and facilitating a shift from antiquated commerce systems. Outsourced Selling propels commerce forward with "Sell High, Buy Low" dynamics, integrating various aspects of digital commerce within the New Economy and addressing issues of inequality and localized productivity limitations in supply chains. With the dismantling of old economy barriers, the mechanics of a scalable economy offer exponential and sustainable growth to local economies, positively impacting lives in both remote areas and major cities. The infrastructure is designed to empower individuals with basic mobile phones, equipped with tools to participate equally in the digital era and global economy, regardless of their geographic location. Primarily accessible via mobile and desktop devices, this system is designed to be accessible wherever an individual resides and integrates seamlessly with the main utilities people use to navigate their lives. It creates an environment where earning in the New Economy aligns more closely with an individual's wealth value and the cost of their standard of living. Many countries risk missing the transition or significantly underestimating the impact of the scalable economy, prompting the development of a groundbreaking blueprint for structuring a digital economy. While each country prioritizes the interests of its people, the New Economy operates as a neutral Software as a Service-based utility, sitting between all nations. ComTechX, an evolving industry, is establishing itself as a Global Chamber of Economies utility, aiming to secure digital cash ownership for all global citizens while maintaining a neutral stance and monitoring all activities. |

||||||||

|

||||||||

Productivity along Supply Chains is the true heart beat of the world! Global Productivity is the Global Digital Markets - it connects local commerce on a real time global platform. It disrupts the way markets operate, removes the incumbents by building out a Free Open Market for the Digital Age. Global Digital Markets recognize the interactions of people in local commerce, networked together on a global scale. - it eliminates the middle tier traders in favor of a democratic market - driven by people for people, globally. Traditional markets and economies typically use post data ( prior events ) to predict and speculate on forecasts - Global Digital Markets are the People's Markets that can only operate in real time and real productivity! - local economies can be magnets that draw Capital from a Global Crowd, serendipitously Every product and service in the world can now get a Competitive Advantage, - anything produced, manufactured and retailed along the Supply Chain, from any Industry, from any location in the world, - any SME or industry leader can use Outsourced Selling on the Global Markets to jump clear of the competition - for free. |

||||||||

fuel - taxis - hotels - restaurants - events - travel - trekking - sharing - Cloudfunding Main St groceries - fashion - books - delivery - content - subscriptions - On-demand - connecting - insurance health - education - energy - housing - leasing - logistics - Used Market - Used Cars + more |

||||||||

|

||||||||

Global Digital Markets is a full market platform tracking Productivity in global locations - networked together, in real time. As a market platform it generates supply and stimulates trade by connecting the global crowd to the complete Productivity Cycle Productivity is defined as the selling and buying of products and services along Supply Chains in both local and global commerce. - each Location where the commerce takes place is identified in real time with any trading activity by its unique Symbol - each Location is open to Sellers located within the district, they can list and sell on the Platform, activity between Sellers and Buyers creates the Productivity that drives the market, - the disruption of commerce's dynamics happens between the time a Seller lists an item and the time a local Buyer buys the item. - the Global Crowd - OMMs actively compete to win the item and generate the full price for the Seller and set the discounted Buying price for the local Buyer, that Competitive environment is made possible using Free Economic Value. It's this complete Productivity Cycle that creates the Global Markets, it identifies activity in the specific locations, and then uses algorithmic economics at the micro and macro levels to collect and distribute the true values across the world to all those linked to the specific locations. It taps in at ground zero in local markets where some of world's products are first traded, it provides the Sellers the tools to list produce at full selling prices ( GPI ) from there the Global Crowd competes to set the buying prices up to a minimum of 20%. Sellers have their own Digital Sales Department where they can be more involved in getting sales and earn extra income streams. All markets can use Outsourced Selling A Seller can list their produce by mobile prior to leaving for the local market and have a Buyer or Buyers accept and waiting to inspect the produce before completing the deal(s), payments are securely escrowed and transferred on agreement. Products moving through the Supply Chains across borders can be listed on the Global Digital Markets, it can operate with the various traders in different countries, handle all currency values, even list products part way along the Supply Chain between stages. For Coffee Growers in a developing country the platform can provide the growers with tools to Outsource Selling, listing their product at a profitable and sustainable Selling Prices and still have Buying Prices so low it would be impossible for traders to ignore, - the same Outsourced Selling can be repeated all along Supply Chains through export and import, all the way to domestic markets. Alternative Energies like Solar Energy can use Outsourced Selling to get the edge and economies of scale over existing energy industries by utilizing the Platform's model in the New Economy. This harnessing of the values in real time, and distribution of the true productivity value, takes global trade and commerce to a new level, which is why the Global Digital Markets is a standalone Platform for the Digital Age. UDC - the neutral trading currency, holds its unique value by combining all major fiat currencies and pegging all the values in real time, this avoids being involved in currency trading wars that traders and Central Banks use to gain advantage over others. By combining all fiat currencies into one basket, it gives Users the option to exchange UDC with any currency without loss or gain, this goes a long way in Buyers and Sellers getting real time value when exchanging goods for money, locally and globally, - this means UDC can be held without any loss of value against a User's normal fiat currency, and only liquidated to a fiat currency if cash is required. - fiat currencies always remain within its country of origin, allowing the currency to continue circulating in the local economy. - exchanges with UDC are completed in the free commerce environment, in everyday cash buys at local brick and mortar stores. The ubiquity achieved by the Global Digital Markets is unique, in that every industry is speaking the same language when it comes to each time Productivity is being exchanged along any Supply Chain, in any Industry, and in any Location, in real time. |

||||||||

|

||||||||

|

||||||||

|

||||||||

| QwickPay operates by integrating UDC into local commerce, as the neutral global trading currency. It's a commerce and trade exchange currency - it's totally free of fees, globally - on desktop, mobile. It's digital cash that's exchanged with fiat currency cash at a local store whenever it's needed. It eliminates fx spreads - all commerce trading is now free from typical currency exchange margins. QwickPay sits in a position where it can provide a payment processing model with unique advantages. There's a great advantage of winning QwickPay Deals with 80% discounts and store them ready for purchases. Users can gain affordability with QwickPay Deals and have automatic discounts of up to 80% ready to spend Instead of Users paying to use credit, now Users can have P2P payments that have discounts built in. As all activity on the Platform there're no banks and no credit cards, so no chargebacks, it all happens in real time. It's simple for Sellers to add QwickPay as a payment option, either in brick and mortar stores or online. It's digital trading cash, it uniquely exchanges with fiat currencies - local Buyers and Sellers still hold the fiat currencies No fiat currency is held by the ComTech Platform, all fiat currencies are exchanged between Buyers and Sellers The exchanges occur only at the local 'brick and mortar stores' to authenticate the value with true productivity International travelers and foreign workers can be paid and send globally - free of any fees As fiat currency is exchanged with digital trading currency in normal commerce, it further reduces a need for banks |

||||||||

|

||||||||

| The common denominator in industry is cost and value - the common denominator in economies are people. Without people, economies can't move forward - the Platform is designed to get people moving forward. |

||||||||

|

||||||||

| Sellers can Sign-up for early access We're opening up to Sellers early - so if your business wants to gain the advantage, please add your details |

||||||||

|

|

||||||||

| Home | Products | Services | Buyer Posts | Seller Posts | ||||||||

Check out a Deal Registration and Cloudfund Strategy See a Snap-Shot view of a Cloudfund strategy and bidding for Deals Cloudfunding generates Price Demand - digitizes 'cash' to flow ubiquitously around the world What's The Monetizing Moment? Cloud Commerce operates by Outsourcing the Selling to the Crowd by Cloudfunding How Sellers Outsource their Selling to the Crowd? |

||||||||

As UDC is validated and exchanged in the Digital Economy it permeates out into local economies! see the connection of players that help achieve 'Productivity' : Global Cloud Productivity Wherever your Location is - you are not alone! - this is the 'RunWay' we're now on, with the New Economy! |

||||||||

| About Us Contact Privacy Policy Terms of Service |

||||||||